Roadmap to Effective Auto Financing: Advice to Protect the very best Deal

Each component plays a vital duty in shaping the result of your auto funding experience, eventually determining whether you drive off the whole lot sensation confident or burdened. Keep tuned to reveal the roadmap to successful automobile funding, where tips and tricks converge to pave the method for a favorable offer.

Recognizing Rates Of Interest

When thinking about automobile financing, understanding rate of interest is vital for making educated monetary decisions. Interest prices play an essential role in identifying the complete price of a car loan. They stand for the quantity billed by the lending institution for borrowing money, revealed as a percent of the major funding quantity. Commonly, the lower the rates of interest, the less you will certainly pay in rate of interest over the life of the finance.

Before signing any type of automobile financing contract, it is crucial to search and compare rates of interest from different loan providers. Aspects such as your credit history, the car loan term, and the kind of automobile can affect the rate of interest provided to you. A higher credit report often leads to reduced rate of interest, saving you money in the future.

A fixed passion price continues to be the exact same throughout the finance term, giving predictability in month-to-month payments. By grasping these fundamental concepts, you can make knowledgeable decisions when protecting auto financing.

Budgeting for Affordability

Comprehending rate of interest is important in ensuring you develop a solid financial foundation for budgeting for price when seeking auto funding. As soon as you have a clear grasp of just how rates of interest influence your general funding quantity, it is time to delve into budgeting methods that straighten with your economic capacities.

To begin, determine your regular monthly earnings and costs to figure out how much you can comfortably assign towards an auto settlement every month. Specialists advise that your overall regular monthly car costs, consisting of funding settlements, insurance, gas, and upkeep, should not surpass 15% of your monthly revenue.

When establishing a spending plan, take into consideration not just the month-to-month loan payments but also the complete expense of ownership. ford finance morris. Factor in added expenses such as insurance policy premiums, registration fees, and possible repairs. Producing an in-depth budget will certainly assist you avoid economic strain and ensure that you can manage your vehicle payments without giving up various other necessary expenses

Improving Credit History

To enhance your chances of securing desirable car funding terms, it is crucial to concentrate on enhancing your credit rating. Your credit scores score plays a substantial function in identifying the interest rates and car loan choices offered to you when looking for automobile financing.

Another means to improve your credit report rating is by making timely repayments on all your existing financial debts. Payment background is an important aspect in determining your credit report, so guaranteeing that you pay your bills on time monthly can assist enhance your rating over time. In addition, aim to keep your bank card balances low and avoid opening multiple brand-new accounts in a short duration, as these actions can adversely impact your credit report. By taking aggressive actions to boost your credit history, you can boost your possibilities of receiving much better vehicle financing handle lower rates of interest and a lot more desirable terms.

Shopping Around for Offers

Having actually diligently enhanced your credit history, the following critical step is to navigate the market by searching for bargains on automobile funding. When looking for the most effective auto financing options, it is necessary to discover multiple loan providers, consisting of financial institutions, credit unions, on the internet lenders, and car dealerships. Each might provide different terms, rates of interest, and incentives, so comparing deals can aid you safeguard one of the most favorable bargain.

Additionally, don't think twice to discuss with lenders to see if they can match or defeat contending deals. Being positive and willing to walk away from negative bargains can empower you to locate the ideal vehicle funding choice that suits your requirements and budget. By looking around and comparing bargains, you can make a well-informed choice and safeguard a competitive cars and truck financing arrangement.

Bargaining Like a Pro

With a calculated approach and a solid understanding of your monetary standing, bargaining like a pro in vehicle financing can significantly influence the regards to your financing. When going into settlements with a loan provider, it's important to be well-prepared. Start by investigating existing rate of interest, incentives, and promos offered by different monetary institutions. Equipped with this info, you can utilize affordable offers to your advantage throughout the negotiation process.

Be willing to walk away if the terms do not straighten with your goals. Bear in mind, you have the power to go shopping about for far better offers.

Do not concentrate exclusively on the month-to-month repayment amount. Consider the overall expense of the funding, including rates of interest, loan term, and any extra fees. Be vigilant for any kind of surprise charges or unnecessary attachments that can inflate the overall expense.

Conclusion

Finally, safeguarding the most effective cars and truck financing deal requires a solid understanding of rates of interest, budgeting for price, enhancing credit report, ford service in morris searching for deals, and discussing efficiently. By adhering to these steps, people can raise their chances of getting a desirable funding choice that fulfills their requirements and economic goals. ford finance morris. It is necessary to be informed and proactive in order to make sound monetary choices when it concerns cars and truck funding

Jaleel White Then & Now!

Jaleel White Then & Now! Alana "Honey Boo Boo" Thompson Then & Now!

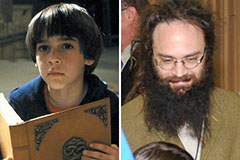

Alana "Honey Boo Boo" Thompson Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Tiffany Trump Then & Now!

Tiffany Trump Then & Now! Samantha Fox Then & Now!

Samantha Fox Then & Now!